Here be Bitcoins!

I’m very excited to read about the spike in value of Bitcoins since the Cyprus current account debacle. It is great news to me that there are enough people out there, in this day of global price transparency and instantaneous transactions, who are dumb enough to build a bubble like this.

The logic seems go like this:

- Bloody hell, Cyprus have decided to take 60% or so off the value of EUR100,000 current accounts.

- Our money’s not safe so long as governments are able to take it from us whenever they like.

- Money’s got nothing to do with any real assets – it’s just an arbitrary means of exchange which gains its credibility only from our willingness to exchange it for things.

- So let’s transfer our credulity to a different “money” which has been set up independently of any of these nasty government types who are out to get us.

I think that’s right, anyway. Add in the usual number of speculators, a solid sprinkle of paranoid fantasists, a smidgeon of reasonable Euro-panic, and here you go:

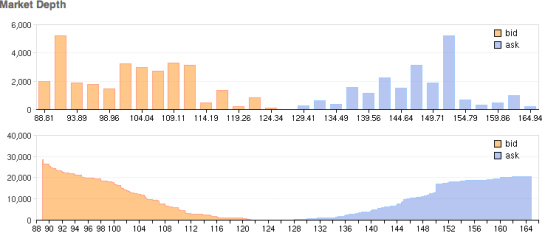

Which is great for those who bought Bitcoins a while ago – they’ve made up to 10 times thier money. Except they haven’t:

What does this mean? It means that we might think that the current value of a Bitcoin is about $120, but if you wanted to buy 10,000 Bitcoins it would cost you more than $144; and if you wanted to sell them again, you would get about $106. That’s a loss of over 25% – about half on buying this monopoly money, and the other half on trying to turn it back into something you can actually spend in a shop.

So that’s the liquidity issue. Obviously, less of an issue if you’re moving around less money; and even less so if you don’t want to move your money back into real currency. And, if everyone really starts using it, this liquidity problem will start to disappear – the bid / ask spread will diminish. Who knows, you might even be able to find somewhere to spend them. I’m afraid that you don’t have many options at the moment.

So, what’re Bitcoins for? They are there to allow us to have a currency which is free of borders and free of government interference. That is – a store of value which we can trust. Which brings us to the nub of the matter. Can you trust Bitcoins more than you can trust dollars? And that answer to that is: Heck, no. Can you trust a currency made-up by someone without even a real name, with little use and border-line untranslatable into real-world value, as a store of value? No. Can you trust governments to not use their laws to restrict its use? No. Can you believe that the algorithms and security behind this digital currency are safer than than the full weight of central banks, the rule of law and centuries of managing a currency on which the stability of a nation or globe relies, as with a real currency? No.

Like many ideas which seem bad, I look forward to watching this one develop. Maybe I’m wrong. But I think this is, for now, a step too far in the development of our connected globe. National currencies are just… better at doing what they’re supposed to do. Avoid Argentina and Zimbabwe, by all means. But, as a group and for the foreseeable future, I don’t see where they’re going to be overtaken by Bitcoins – in liquidity, in exchangeability, in stability, in plain old usefulness.

So, in the meantime, if you want to invest in something which is completely bloody useless but which will increase in value when fiat currencies seem dubious – go and buy some gold.

PS – You may note that the first chart shows a price of approximately $144 / Bitcoin and the second shows approximately $124. That’s because the first chart if a few hours older than the second. In the meantime the most used BItcoin exchange, Mt. Gox, went down under a digital attack.

PPS – As a student of science fiction, I note that corporation-backed currency is a common trope. IF the corporations take over the world, this is entirely feasible (even if only, like most science fiction, a rehashed version of the past – Scottish bank notes are still issued by individual banks, as they ever were, for instance). Bitcoin ain’t that, though.